I would like to ask a question:

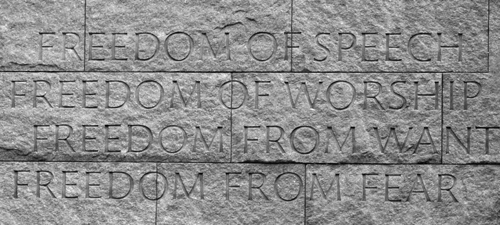

- Why aren’t human rights a central consideration in an investment decision?

In late 2013, I was asked to give a presentation to the UN Working Group on the post 2015 development goals, and I led the discussion off with this question. Needless to say, the committee was surprised by the question and by who asked it. However, I believe we do not ask this question nearly enough in the narrow world of capital.

Lets tell a secret that needs to be told. Much of the assumptions that we employ and claim to be true in the capital business are just convenient myths. We then apply mathematics, much of it also conveniently simple, to these convenient myths, and use them to build the structures of the business, all the while not looking too much at what goes on behind the curtain.

Do you need a tangible example? Try the efficient market hypothesis. This at its most basic is a statement about information theory. However, the value of market information is inversely proportional to the number of market participants using it – that is, the market is made as a result of information asymmetry. A truly efficient market has broad entropy and very few opportunities for profit. Yet we promote this idea heavily in our business schools and celebrate it in the public market. And beyond that, attempt to apply it in private equity.

So back to the original question. There are many answers, ranging from “human rights are the concern of individuals who are free to make their own choices; transactions are independent of an individual’s concerns”, to “the consideration of human rights is already efficiently priced into the transaction”, to “the laws on human rights are not applicable in a transaction”. Presumably, the principles behind the laws on human rights are also not applicable. Also, I suppose we must presume that individuals are not generally coerced against their best interests by economic factors.

Perhaps the flatland of the efficient market hypothesis is really a very noble attempt to eliminate avarice from the market, and thereby, eliminate one of the seven deadly sins. I suppose you could argue that this makes the world a slightly better place, which at its core is an attempt to protect human value and thereby protect human rights. Really? Well, it has to be about something, because for sure, it is not about describing the actual capital market.

So I haven’t even started answering the question. But over the next several posts, I would like to try to dig a little deeper.This isn’t going to be a Dworkin vs. Hart debate on the nature of law, its just a few miscellaneous ramblings which are rolling around in my head as I work on more formal discussions on capital and development. Lets see where they go.

Remember, you can always throw your shoe at the monitor if you don’t like what I have to say…