The Shape of the Problem:

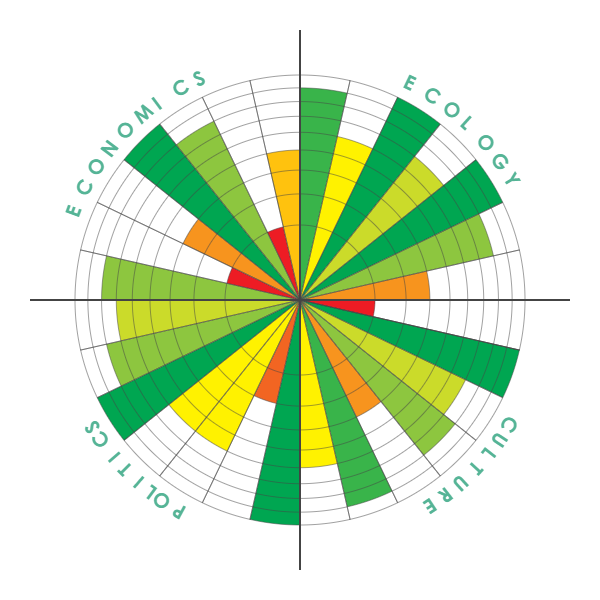

Worldwide, societies face critical problems in core sectors of the economy that greatly impact well-being and sustainable development. Examples include providing broad access to healthcare in the context of escalating costs, addressing the social and economic effects of climate change, arresting biodiversity loss that increases the risk of successive pandemics, and expanding safe and sustainable agriculture. The transitions required to address these problems must also reduce greenhouse gas emissions at pace.

These problems are linked in their cause and in their effect. Climate change has significant impact on human health and on agriculture, and unsustainable agriculture practice is a cause of climate change. The inter-connectedness of the problems is recognized but is not a core consideration in the public policy related to each of them. Actions taken on the challenges of global transition are confounded by the interaction of social, economic, environmental, and political factors, and by fundamental technical and practical limitations. Unanticipated consequences can arise which affect the measurement of overall success.

The challenges appear intractable. There is a need to make a transition from current policies towards more integrated and sustainable structures. This transition needs to occur at a global level; the history of previous efforts, often limited to electoral cycles, is full of failures to engage broadly enough or for a long enough term to effect real change.

What about the Existing Financial Services Model?

The transitional challenges share a number of features related to investment and economic development:

Market inefficiency: |

Risk in existing economic and business models is not fully priced in the capital markets, resulting in a market inefficiency that limits the interest of market actors to effect change. |

Investment thesis: |

The complexity of factors related to global transition are such that simple and opportunistic solutions cannot address them. |

Structural weakness: |

The investment horizon required for global transition is longer than normally feasible using investment vehicles currently offered. |

Governance failures: |

There is misalignment between those affected by critical problems and those responsible for originally creating them. Concentrated ownership of the means of production undermines broad and transparent governance of the transition required. |

It is clear to me that the existing financial services model does not provide a workable solution to global transition. A lot more work is required.

A Future Model ?

Explicitly addressing these features requires structures and developments that move beyond what is currently offered by the financial service industry and that must have the following attributes:

Market: |

Define a path for Institutional Investors to migrate from the unpriced risks in the current economic model by gaining an economic premium as the lead investors in the developments required to create a sustainable future. |

Investment: |

Mechanisms to engage and resolve the complex and multi-dimensional character of global transition, rather than applying the idiosyncratic and opportunistic approaches currently used. |

Structure: |

Permanent capital structures with 25+ year timeframes that match the requirements of transition, rather than limited partnership funds with 10 year horizons. |

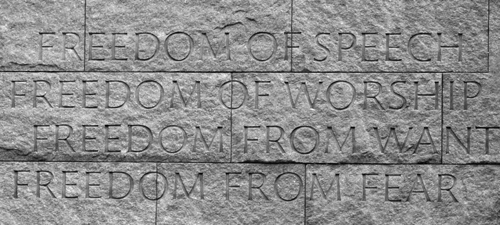

Governance: |

Greater alignment across the economic spectrum by deploying broadly held capital within Institutional Investors such as pension plans to own the means of production attached to the solutions to global transition, effectively “re-mutualizing” the economy and reversing the current trend that concentrates ownership of capitalism by a small group of persons. |

A solution will require a major shift along these four dimensions in order to be effective. While there are many solutions being proposed along each axis, all four need to be engaged and advanced upon together. An integrated solution is necessary.

And the Green New Deal?

Aha, yes. “We are all Keynesians now”, to stand the Friedman quote on its head. But are we really? Are we willing to re-assess the quantitative structures of the economy in order to include the cost of the environment, both physical and social? A true Green New Deal would do so. I have not yet seen work that explicitly re-imagines national and international economies in this way, much less seeing work that articulates a new level of economic stability associated with such a re-balancing. This was, after all, how Keynes re-imagined the problem of full employment that set the basis of the old New Deal.

But that is a topic for another day

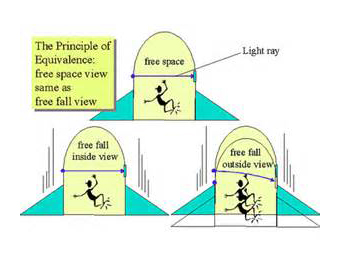

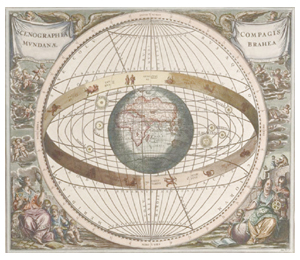

The earth is the centre of the universe – what a crazy thought, right? But during the various transitions from the geocentric, to the heliocentric and, more recently to a relativistic model of our place in the cosmos, many forward thinking persons lost their place in society, their livelihoods, their lives. Great efforts were made to maintain a status quo on this question, to the level of absurdity! It is still going on now. Whether in astronomy or in mathematics, medicine or architecture, the stranglehold of conservative thinking has significantly hampered progress.

The earth is the centre of the universe – what a crazy thought, right? But during the various transitions from the geocentric, to the heliocentric and, more recently to a relativistic model of our place in the cosmos, many forward thinking persons lost their place in society, their livelihoods, their lives. Great efforts were made to maintain a status quo on this question, to the level of absurdity! It is still going on now. Whether in astronomy or in mathematics, medicine or architecture, the stranglehold of conservative thinking has significantly hampered progress.